Life insurance premiums depend on various factors that gauge the financial risk for the insurance company. Hence, insurers frequently mandate a medical exam to evaluate applicants' health and ascertain their insurability. This examination helps determine the appropriate premium to mitigate the company's risk. If you're considering life insurance, this article can address common queries regarding these medical exams.

Are you ready to take the health insurance exam? Or are you wondering who will take ‘my life insurance exam questions?’ at PassMyProctoredExam, we have life insurance experts who can take my life insurance exam questions for you at a friendly cost. We can also provide practice questions to help you pass your life insurance exam. Don't take the exam without adequate preparation. Contact PassMyProctoredExam today and equip yourself with the necessary information.

What's on My Life Insurance Exam Questions

The specifics of the exam vary depending on the state where it is administered, including factors like the number of questions, time constraints, topics covered, and the overall structure of the exam.

Typically, the examination covers a range of topics, including:

- Health maintenance organizations (HMOs)

- Health insurance tax implications

- Annuities and their tax considerations

- General knowledge about life insurance plans,

- Dental coverage

- Medical plans

The questions in some states' exams may total 150 or as few as 50 in others. Similarly, the exam duration varies, with some states allotting 2.5 hours while others provide 1.5 hours. It's essential to verify the specifics of your state's requirements to ensure you have accurate information for your examination.

What Happens During the Life Insurance Exam?

When a medical exam is necessary for the policy you're seeking, the life insurance provider will provide the exam and cover the expenses. A professional will contact you to arrange the appointment, and the examiner will visit your workplace or home. The examination typically lasts between 15 and 45 minutes, varying based on the specific requirements. It consists of a questionnaire and a simple physical examination.

The Questionnaire

The insurance company underwriters address the risks in your lifestyle and your medical information; the questionnaire covers the following topics:

- Your prescriptions

- Family medical history

- Recent doctor visits, current doctor information

- Current diagnosis information

PassMyProctoredExam experts are the answer to your questions, taking my life insurance exam questions. Here is a glance at practice questions from PassMyProctoredExam.

PassMyProctoredExam Life Insurance Exam Questions

- What is the purpose of a life insurance medical exam in the underwriting process?

Answer:

The primary purpose of a life insurance medical exam in the underwriting process is to assess the applicant's health status. This examination helps the insurance company evaluate the level of risk associated with insuring the individual. Insurers can determine the appropriate premium rates and coverage amounts by obtaining information about the applicant's medical history, lifestyle habits, and current health conditions.

- What's the difference between term whole insurance and life insurance?

Answer:

Term life insurance covers a specific period, from 10 to 30 years, and pays out a death benefit if the insured passes away during the term. On the other hand, whole life insurance offers coverage for the insured's entire lifetime and includes a cash value component that grows over time. Additionally, whole-life policies typically have fixed premiums, while term-life premiums may increase at the end of each term.

- What is a primary beneficiary in a life insurance policy, and how does it differ from a contingent beneficiary?

Answer:

A primary beneficiary is an individual or entity designated to receive the death benefit from a life insurance policy upon the insured's passing. If the primary beneficiary cannot receive the benefit, or if they predecease the insured, the contingent beneficiary receives the payout. Unlike the primary beneficiary, the contingent beneficiary only receives the benefit if the primary beneficiary cannot.

Read More: Take My Proctored Exam - PassMyProctoredExam

- What is a critical illness rider in a life insurance policy, and how does it enhance coverage?

Answer:

A critical illness rider is an optional add-on to a life insurance policy that covers specific serious illnesses such as cancer, heart attack, or stroke. If the insured is diagnosed with a covered illness during the policy term, this rider pays out a lump sum benefit to help cover medical expenses or other financial needs. It enhances coverage by providing additional financial protection beyond the standard death benefit.

- How do life insurance companies determine premium rates for applicants?

Answer:

Life insurance companies determine premium rates based on several factors, including the applicant's age, gender, health status, occupation, hobbies, and lifestyle habits like smoking. Generally, younger and healthier individuals with low-risk lifestyles pay lower premiums. In comparison, older individuals or those with pre-existing health conditions may face higher premiums to offset the increased risk of insuring them.

Life Insurance Education Requirements

You have no strict requirements to sit for an insurance exam, so a high school diploma or a degree is just fine.

Studying for the Life Insurance Exam

Passing the life insurance exam doesn't come quickly; you must spend many hours preparing. But what happens when you've no time? That's where PassMyProctoredExam experts come in. We know how precious this exam is to you. That is why you can trust us with your proctored insurance exam, and we guarantee you an A grade.

Answer Explanation

Many life insurance exam test questions include explanations for answer choices, which might lead test-takers to believe they grasp the concept fully after reading these explanations. However, explanations usually only partially understand the question's broader context. Even if an explanation seems clear, digging deeper into every related concept is essential until you're confident in your comprehensive understanding.

This is tricky for students, especially if you haven't prepared thoroughly. However, you shouldn't worry about my life insurance exam questions. Experts from PassMyProctoredExam have been handling life insurance exams for a long time. This means our experts are in a better position to handle your exams.

Read More: Where can I take my GED exam?

Winding Up

Sometimes, we need to pass exams but don't have what it takes to pass with an A. You don't have to leave your matters unattended when PassMyProctoredExam can take your life insurance exam at a budget-friendly cost. We've helped many students before. Don't wait to fail; try us today and pass your exam on the first try.

Place Your Order

Placing your order to have your proctored exam done by us is simple. If you need to “pay someone to take my proctored exam,” contact us directly through WhatsApp or phone. Once you place your order and pay the required fee, you will be matched with the best expert to take your exam. Get a guaranteed A in your proctored exam, by placing your order through WhatsApp now..

If we can take exam for you, now imagine how our practice questions and study guide will be. 100% accurate as the actual exam

Or you are interested for practice questions?

Get practice questions that are guaranteed to make you pass the exam 90% or get your money back.

- Prepared by people who accessed to questions before

- Similar styling to actual teas exam

- Prepared to ensure guaranteed pass or money back

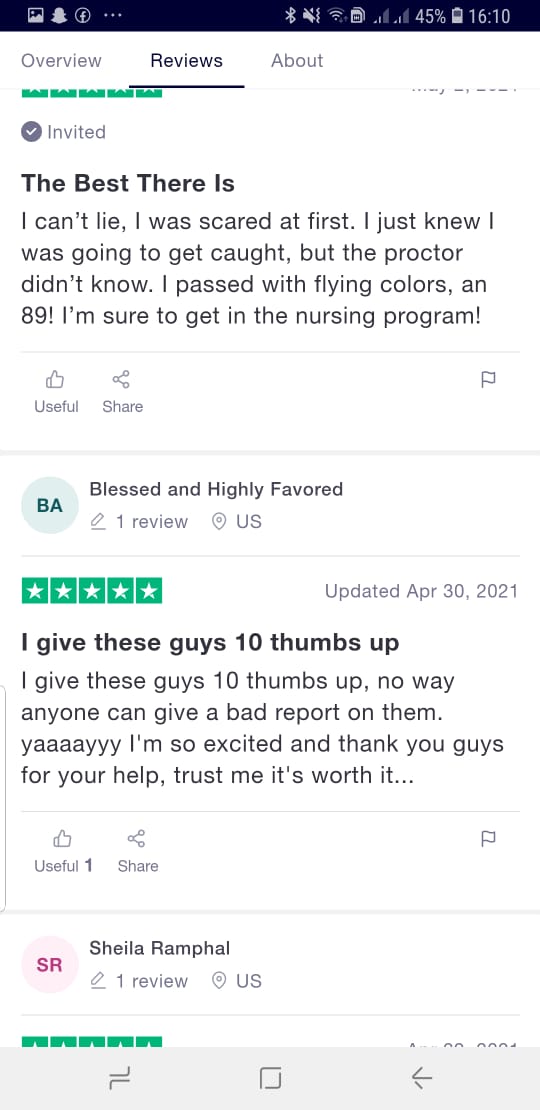

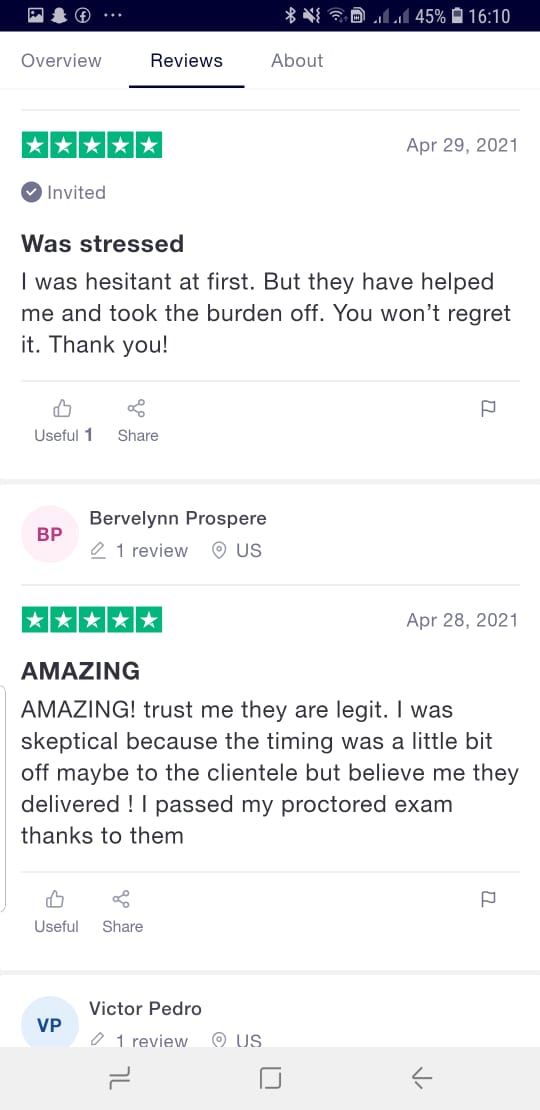

- 5 star rated reviews on trust pilot

Customer reviews